As far as I know, there are more than 300 registered stock brokers in India. In this post, I make an attempt to identify the best day trading broker in India who is good for intraday trading.

More and more traders are getting attracted to day trading because of the flexibility it offers. But one has to be on his toes all the day to come out with profit.

For success in intraday trading, two factors are very crucial.

- Trading strategy (method + Psychology)

- Broker used for day trading

First parameter is not subject of this article. But I will explain how to select a good day trading broker in coming section.

But before that, if you are new, let me share you some basic information about Intraday trading

What is Intraday Trading or Day Trading?

As the name suggests, you close your open positions by end of the day. No position is carried over to next day.

Intraday trading which is also popularly known as day trading is a type of trading in which you buy shares of a company (or F&O contracts) and sell them before the close of stock market (before 3.30PM)

For example, You are bullish on Infosys and confident that price of shares will move up today, and buy 100 shares of Infosys at Rs 700.

Now, as per your prediction, if the price rises to Rs720 before 3.30PM, you can sell the shares by pocketing Rs20/share profit.

It is also possible to sell first and buy later. It is called Short selling.

If you feel that Infosys share price will fall today, then sell shares at Rs700 at the opening of the day and buy them at Rs 690 to make Rs10/share profit.

Advantages & Disadvantages of Day Trading:

Day trading has its own pros and cons. It is upto us to adopt it or discard it.

Benefits of Day trading:

- No overnight risk (Gap up/down due to news)

- Opportunity to make quick money

- Free to decide if you would like to trade today or not

- No need to work after market hours

- Availability of leverage from broker

Drawbacks of Day trading:

- It is stressful as one need to be infront of system most of the time

- Day trading requires more discipline than other types of trading

- Higher brokerage charges & taxes eats up profits considerably

How to select the best stock broker for Intra-Day Trading In India

While choosing a good day trading broker we need to consider multiple parameters. I am listing major 6 qualities that a ideal intraday broker should meet.

- Outstanding Trading terminal:

A day trader can not afford slow and lagging trading terminal. A slight downtime can quickly turn a profitable trade to a loss making one. Also, broker should offer it free of cost. ( Please confirm with the broker if there any subscription fee for using the terminal. Few brokers try to make out for the lower brokerage charges by charging for usage of trading terminalor data feed)

- Reasonable Margin/Exposure:

Day trading is all about using margin from broker. But if a broker offering very high leverage then also it is a red flag. If a customer using high leverage defaults, he will put funds of the broker and all their other customers into risk.

- Lower Brokerage Charges:

I can not stress much about it. If a broker is charging on percentage basis, you will end up in paying considerable amount of your profit as brokerage itself. Always go with discount brokers who levy flat fee irrespective of traded quantity.

- Supported Order Types:

Apart from regular order types like market order, limit order, Stop loss order, check if the brokers support special order types like Bracket order & Cover Order which are useful for locking profit/minimizing the loss. A good broker for intraday trading in India must provide these special types of orders.

Ranking For Best Day Trading Broker In India 2026

Now after going through the background of intraday trading and qualities of a good day trading broker, it is time to identify the top brokers in India who are best suited for Intraday trading. I have short listed some of them based on my research and user’s feedback.

Here is the list of Best day trading brokers in India,

- 1. Zerodha Intraday Trading Broker

- 2. Upstox Intraday Trading Broker

- 3. Angel Broking Intraday Trading Broker

- 4. SAS Online Intraday Trading Broker

- 5. TradeSmartOnline Intraday Trading Broker

- 6. 5Paisa Intraday Trading Broker

- 7. FYERS Securities Intraday Trading Broker

#1 Zerodha

Zerodha meets most of the qualities I put up above to become leading intra day trading broker of India.. They are the No.1 stock broker of India with highest number of customers.

No other broker in India including ICICI Direct & Sharekhan have customers more than that of Zerodha.

The brokerage charges for delivery segment is Zero with Zerodha , still company is making profit because of large number of day traders who trade with them. This itself is the proof that, Zerodha is the best broker for intraday trading in India

For intraday, they charge Rs20/trade. All their profit comes through this as they have lakhs of day traders as their customers.

Zerodha Brokerage Charges for Intraday Trading:

Below is the brokerage summary of Zerodha.

Below is the detailed charge structure for intraday trading

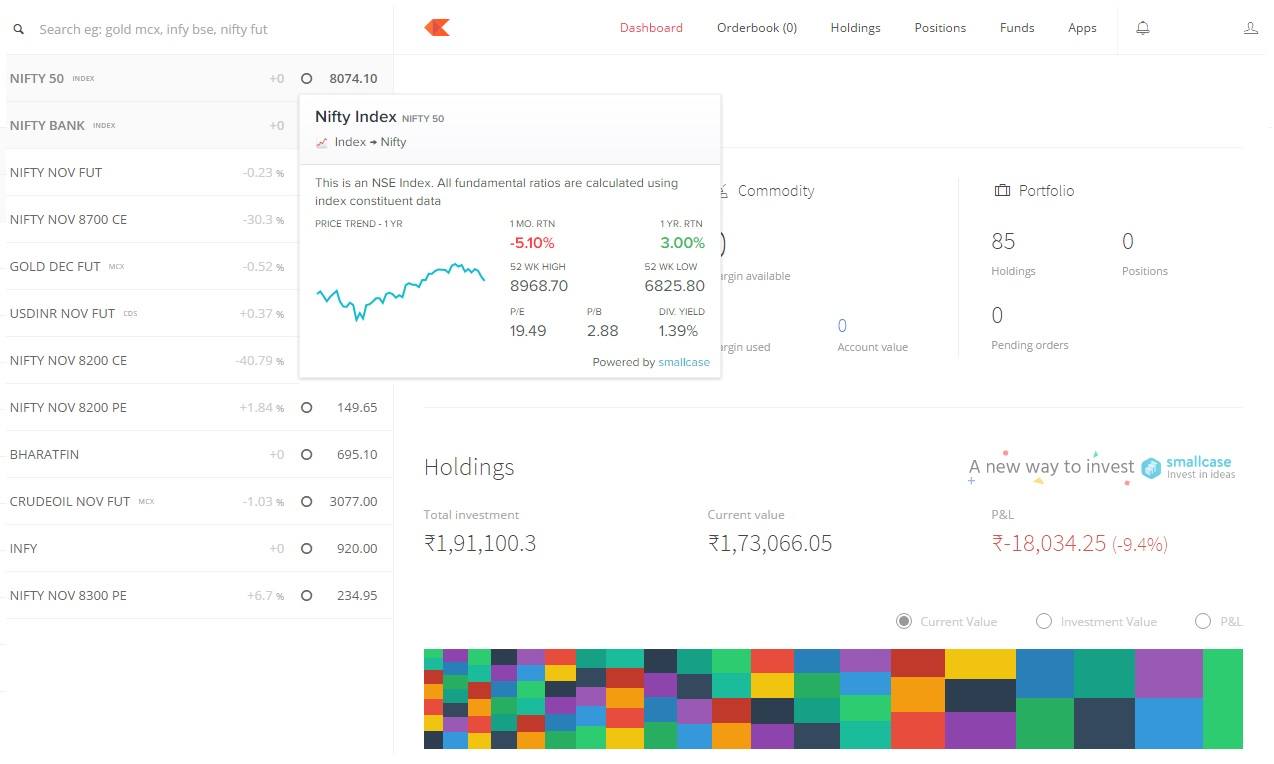

Zerodha Trading terminal:

KITE is the trading terminalfrom Zerodha. It is minimalistic, simple and elegant in nature.

What I like in KITE is the clutter free interface which allows me to focus on what is more important to me. There are many terminal from other brokers which have lot of information and news flashes which I rarely use.

All these factors make Kite the best platform for Intraday trading.

Zerodha also offers special order types like Cover Orders and Bracket Orders.

Margin offered by Zerodha for Intraday Segment:

As far as leverage is considered, Zerodha is little bit conservative here. They say, they don’t want to risk their business and their customers faith by offering too high exposure.

They provide upto 3 times margin for intraday and higher margin of 4X to 15X for Cover/Bracket order.

How much Brokerage can be saved with Zerodha?

Zerodha’s brokerage plan is best suited for intraday traders trading in both cash and F&O.

Let us understand how a intraday trader benefit by switching to Zerodha from a full service broker. I switched from Sharekhan to Zerodha for this very same reason.

Saving For Day Trader:

Let us assume you buy Rs 10lakh and sell 10lakh worth of shares daily. That means in around 20 trading days of month it will be 400 lakhs.

ICICI Direct charges 0.0275% of total traded value, hence the brokerage charges per month is Rs400Lakh * 0.0275% which is Rs 11,000.

So yearly it would be,

Rs11,000 * 12 months = Rs 1,32,000

Now Zerodha charges Rs 20/trade for intraday. In Zerodha, brokerage is not based on trade value. For each order they charge Rs20 irrespective of trade value.

Hence per day it would be Rs 40 (Rs20 for buy and Rs20 for sell) and for each month it would be 20* Rs40 = Rs 800

So per year it is Rs 800 * 12 months = Rs 9,600 only

Hence it is huge 90% savings and it indirectly adds to our profit that can be used for next trade.

Opening account with Zerodha:

Account opening is completely online with Zerodha and can be opened in less than 15minutes. It is based on Aadhaar based OTP.

You will need PAN Card, Aadhaar Card, Cancelled Cheque (Or Bank account passbook) and Specimen signature on a white paper. One need to take photo of all these and upload. For detailed and step by step procedure about opening account with Zerodha, refer this article.

SaveRs200: you can save Rs200 by opening the account online. Use below Link to save Rs 200. It can be opened completely online without any paperwork.

#2 Upstox

Upstox is second biggest discount broker after Zerodha. The brokerage firm is based out of Mumbai.

Upstox is backed by well known personalities like Ratan Tata.

And as far as other factors are considered, there is no much difference between Zerodha and Upstox.

Upstox Brokerage Charges:

It is slightly higher than Zerodha as they charge (0.05% or Rs20/trade) against (0.03% or Rs20/trade) of Zerodha. It does not make much difference if your trading volume is not very small.

Below is the details of brokerage & other charges for Intraday Segment.

Below is the summary of the Upstox fees for all segments.

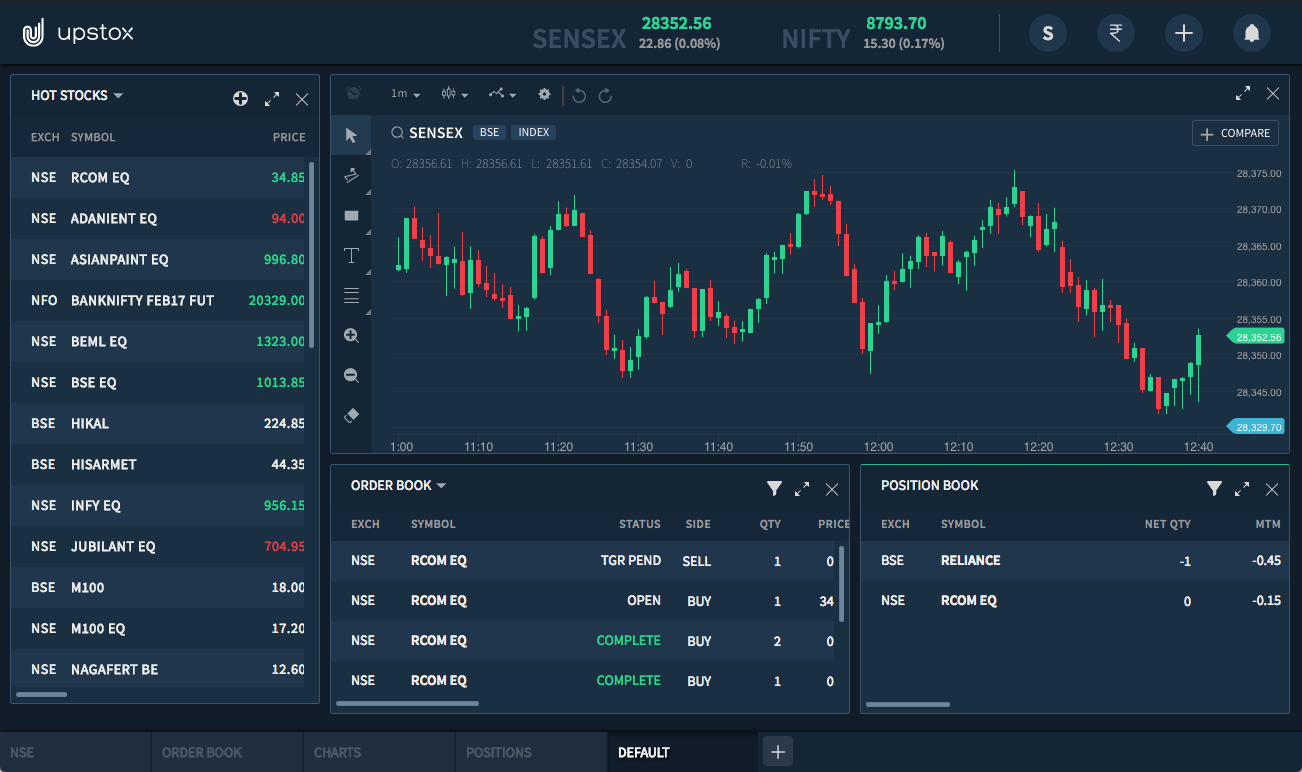

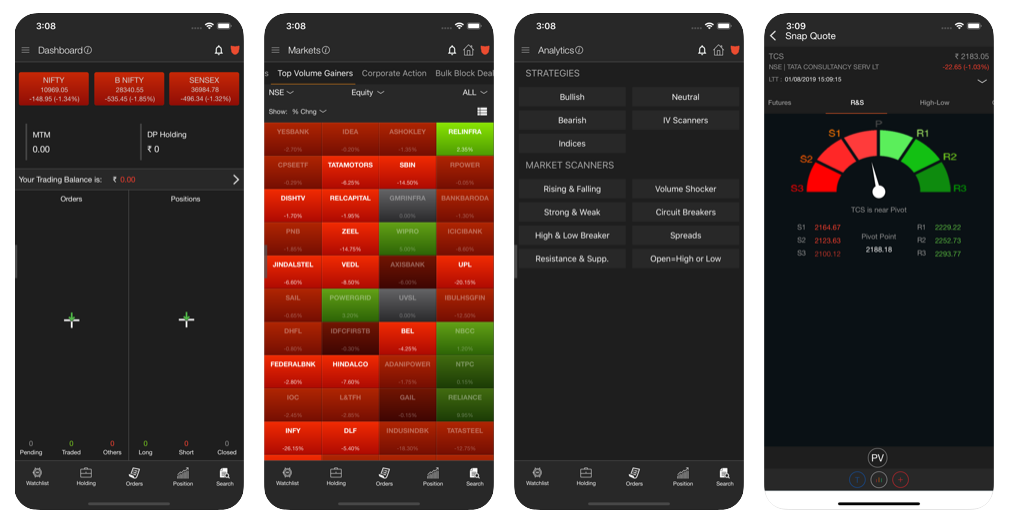

Upstox Trading terminal:

Earlier Upstox used to offer third party software called NEST. But following Zerodha’s footsteps they have also developed inhouse trading terminal called Upstox Pro.

Mobile version of Upstox is available and can be downloaded from Playstore.

Upstox Margin:

Here, Upstox has upper hand against Zerodha. They have special plans for the traders who are seeking higher margin for intraday trading. It is called Priority pack.

In Priority pack, one need to pay higher brokerage of Rs30/trade for intraday trading and also In Priority Pack , you need to pay monthly charges of Rs 999 for Equity, F&O and Currency and Rs 499/month for Commodities.

Because of larger margin, Upstox is definitely one among the best day trading broker in India.

#3 Angel Broking

Angel Broking is another reputed stock broker of India. They recently changed their brokerage model from full service to discount brokerage.

They used to charge around 0.03% for intraday trading earlier. But now they have altered it to Rs20/trade, similar to Zerodha.

But again if you compare Angel Broking with Zerodha, the (0.03% or Rs20/trade whichever is lower) condition is missing.

That means in Angel Broking, you will pay Rs20 even if you trade Rs100 worth of shares. But in Zerodha you will pay Rs3.

But still, Angel Broking after incorporating new brokerage plan has become one of the best broker for Intraday trading in India.

Check the brokerage plans of Angel broking called, iTrade Prime Plan.

Brokerage Charges of Angel Broking :

Angel Broking Margin:

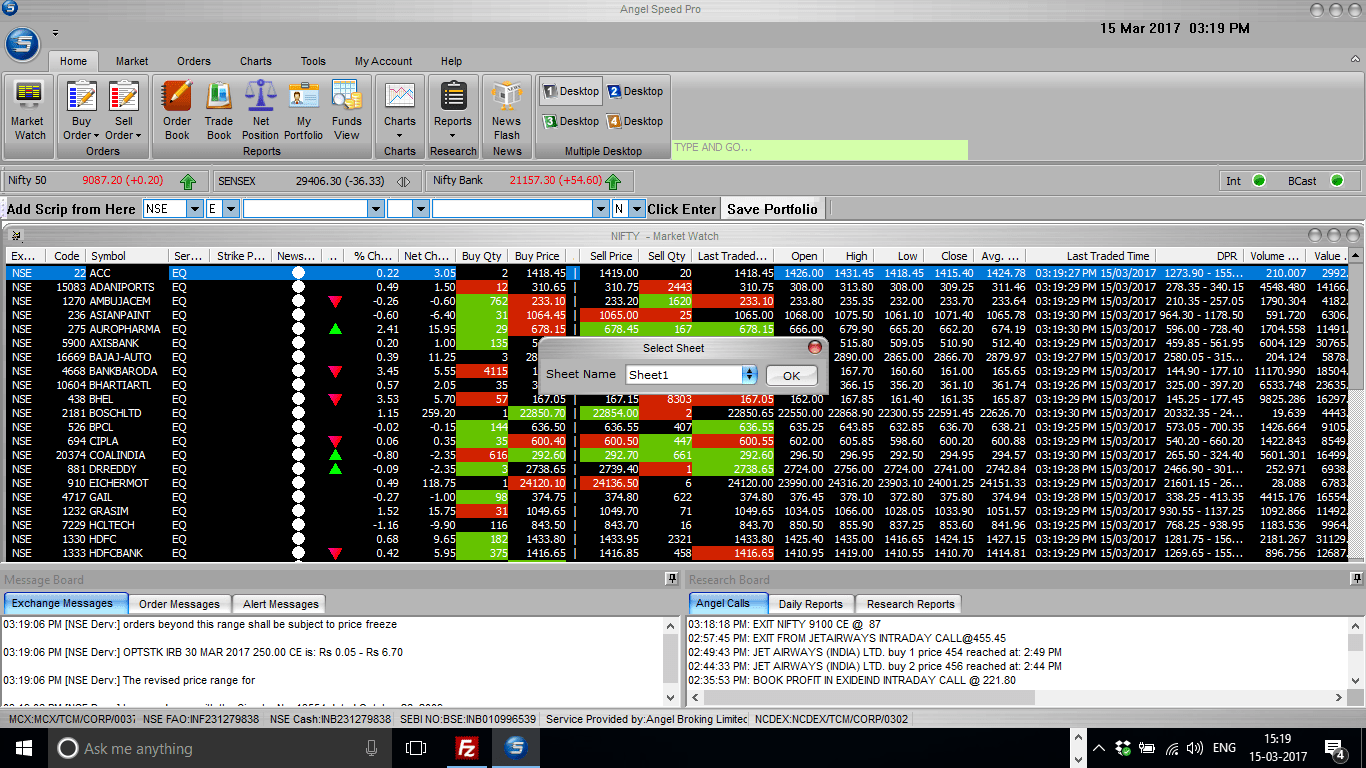

Angel Broking Trading terminal:

Desktop terminal of Angel Broking is called Angel Speed Pro. One need to install the application in his system.

#4 SAS Online

SAS Online is probably the broker with lowest brokerage charges for Intraday trading. Hence if you purely consider brokerage only, they are the best broker for day trading in India.

However, they need to improve on other aspects such as customer support, terminal and higher transaction charges.

Brokerage Charges of SAS Online :

Margin/Leverage Offered by SAS Online:

SAS Online Trading terminal:

SAS Online provide the trading terminal called “Alpha Trader”. It is developed by a third party vendor called TradeLab.

Mobile and Web version of Alpha Trader is available.

#5 TradeSmart Online

TradeSmart Online is online discount brand of VNS Financial Service Limited.

VNS is well known full service stock broker in Mumbai, they are into the brokerage business for more than 2 decades.

TradeSmart Online is also a good stock broker if you planning to to do day trading.

They have two types of brokerage plans, customer can choose any one of them based on his requirement.

Trade Smart Online Brokerage Charges:

Below is the summary of the brokerage charges of TSO

One can either choose flat Rs15/order plan or 0.007% plan (Value Plan).

Value Plan will suit for small intraday traders who trade lesser valued scrips or quantities.

Below is the details of the other charges involved for intraday segment.

TradeSmart Online Margin:

Below is the margin details of TradeSmart Online

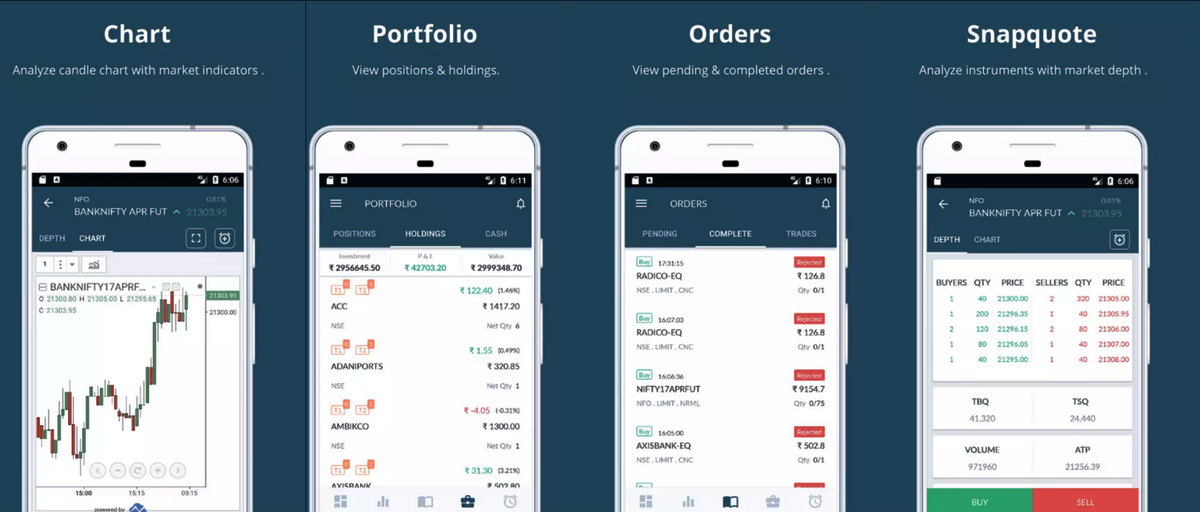

TradeSmart Trading terminal:

TSO provides terminal for all 3 types namely Desktop, Web and mobile.

- Desktop : NEST

- Web : SINE Web

- Mobile : SINE

Use below link to open the TradeSmartOnline for Free,

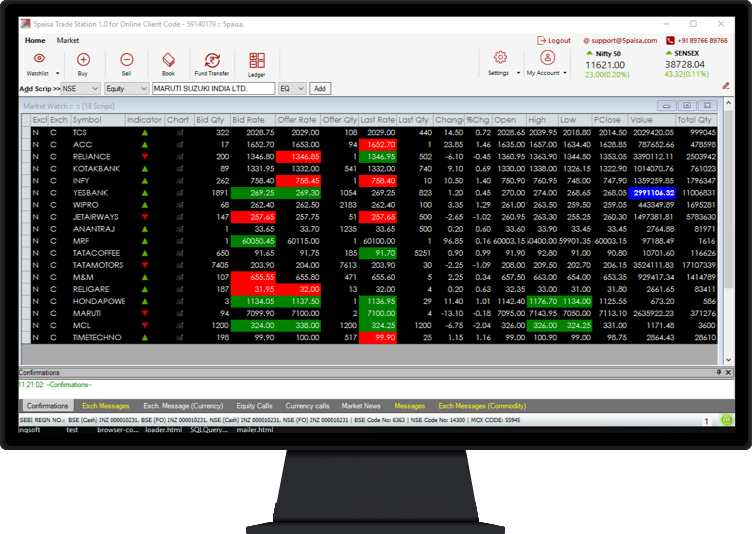

#6 5Paisa

5Paisa is also a strong contender in becoming best broker for Intraday trading.

They are the discount brokerage arm of India Infoline (IIFL). IIFL is a reputed full service broker of India for more than 2 decades.

Recently they have increased their brokerage charges from Rs10/trade to Rs20/trade for intraday trading.

The stock broking company also has different brokerage plans in which delivery brokerages is free and intraday brokerage is Rs10/trade.

Check the details below,

5paisa Brokerage Charges:

By paying additional charges, you can avail lower brokerage slab in Titanium and Platinum plans.

5paisa Margin/Exposure:

5paisa Trading terminal:

terminal Trade Station is the terminal by 5Paisa. It is a desktop installable application.

They also offer Web based and Mobile app for trading. However, desktop based software is ideal for day traders as it will have short cuts for quick order placement and modifications.

They are offering promotional offer of free account without any account opening charges. Use below link to avail the offer.

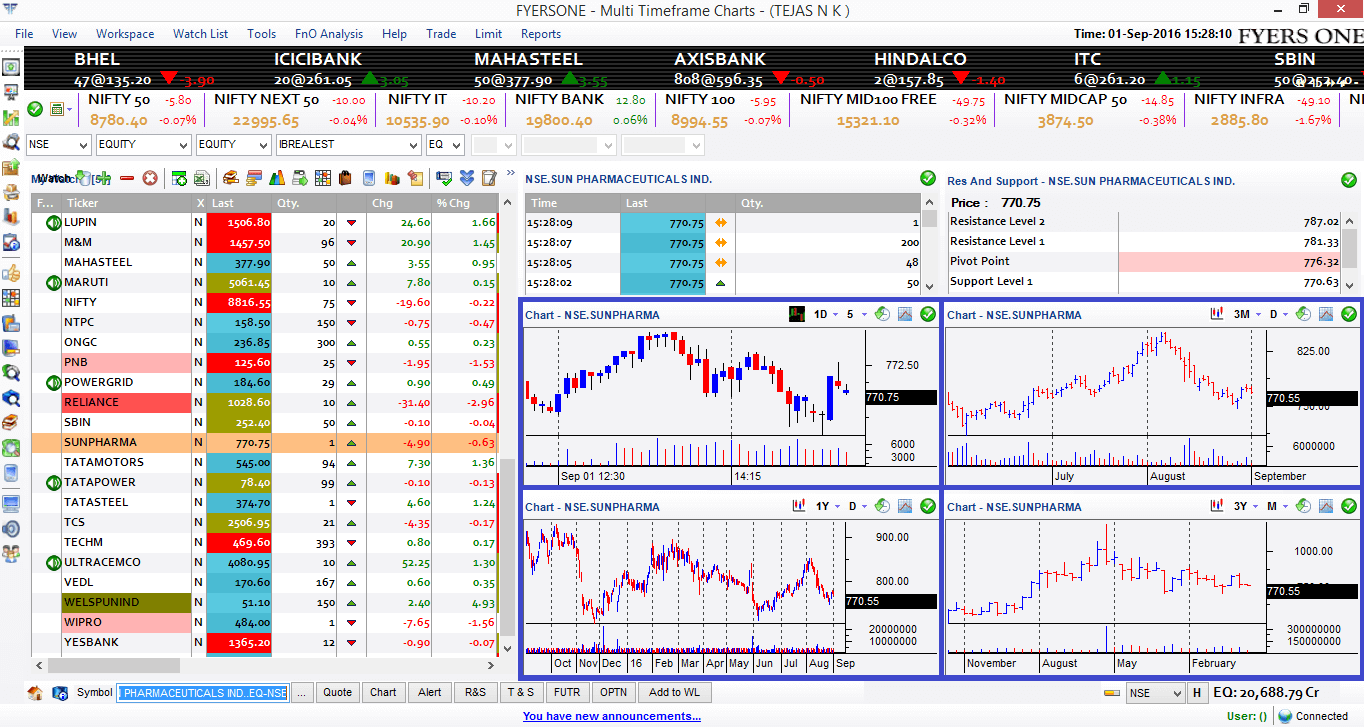

#7 FYERS Securities

FYERS is also a strong contender for becoming best broker for day traders because of the above average trading terminal.

FYERS is a Bengaluru based discount broker. They entered to market in 2015 hence there was no first to market advantage for FYERS when compared to Zerodha.

Brokerage charges of FYERS is almost same as that of Zerodha & Upstox.

FYERS Brokerage Charges :

Exposure provided by FYERS Securities :

FYERS Securities Trading terminal:

The trading terminal from FYERS, known as “FYERS ONE” is built for professional day traders with many loaded features like advance charting, F&O Analysis tool and stock screeners.

FYERS ONE is a desktop based terminal hence one need to install in his desktop/laptop.

FYERS is offering Zero account opening charges, use below link to avail the offer.

Best Day Trading Broker In India – Final Thoughts

While selecting a broker for intraday trading, never decide only on the basis of brokerage charges.

Look for other parameters as well, such as Margin and trading terminal etc.

But the most important parameter which can not be quantified is Customer Service. No point in opening the account for other factors and not getting required support whenever in need.

In that way, I suggest Zerodha as best day trading broker in India. They have highest number of customers than any other brokers in India which is indirect way of assessing quality of customer support.

You can choose any of above brokers and all are good for intraday trading. But I would like to stick with the leader and hence using Zerodha. Paying little bit more does not bother me and reasonable margin levels from them make me feel safe about my funds.

You May Also Like To Read :

- 10 Best Discount Brokers of India who can reduce your trading costs significantly

- 6 Stock Brokers of India well suited for Options trading

- Top 7 Commodity brokers of India to trade in Commodity Segment

- Stock Brokers best suited for applying to IPO Investments

- 10 Leading Brokers who provide High Margin and also Low Brokerage

- Stock Brokers Who are Known For their Best Customer Service in India

- List of Stock Brokers having Highest Active Clients in India

- Tool to do Side By Side Comparison of Any Two Stock Brokers of India

- Find the Best Stock Broker In Your City

- How to Choose the Best Stock Broker In India as per your Requirement